How to embrace new invoicing regulations

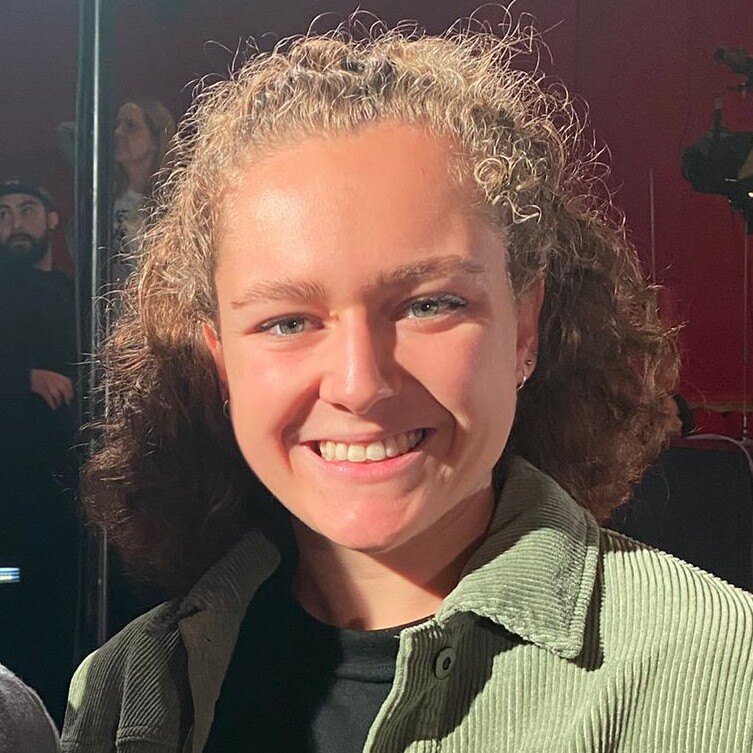

This week, we’re excited to be joined by Hajnalka Balazs, P2P Process Lead at leading manufacturer NSG.

An advocate for e-invoicing and digital compliance, Hajnalka brings two decades of expertise across the AP-P2P space. In this episode, she gives an overview of new e-invoicing regulations in Europe, including how to prepare and why embracing mandated changes in invoice processing is in the best interest for your entire CFO office. She offers a new perspective: just because it's mandated doesn't have to mean it's scary.

Watch the episode ▶️

A bit about Hajnalka:

Hajnalka started her career as an AP Invoice Processor. What started as “a compliance headache,” as she calls it, grew into a passion, as she realised there was a knowledge gap in invoice processing and took it upon herself to close that gap.

“The first step is recognising that these changes are happening and accepting that as a business, you need to adapt.”

The regulations to have on your radar

“The coming year will be a game changer,” says Hajnalka.

Broadly, everyone in Finance, especially AP, needs to monitor ViDA – a new, government appointed system that leverages e-invoicing to provide real-time digital reporting for cross-border trade. Primarily aimed to reduce VAT fraud and lessen administrative and compliance costs, Hajnalka explains that this new EU regulation will significantly change the VAT system within the European Union.

She explains, “Any company involved directly or indirectly with the EU needs to be aware of this.”

Large corporations in France, Belgium, Poland and Germany are already implementing mandatory e-invoicing and reporting.

As of now, these mandates extend only to domestic transactions, but one thing Hajnalka is certain of: “If vendors send e-invoices, your team must be able to receive them. There’s no excuse for not complying anymore.”

Advise for companies to prepare for this upcoming wave of e-invoicing

"It can feel like a huge shift,” Hajnalka admits. “It’s a lot to take in and manage. There’s so much to pay attention to and organise.”

She emphasises that organisations should start by grasping the fundamentals:

1) Where you operate

2) The regulatory landscape in each country you operate within

3) The core principles of e-invoicing

This knowledge enables your team to ask the right questions when working with IT or external providers, ensuring activities stay aligned with compliance requirements.

This leads to Hajnalka’s second point as she stresses that riding this wave isn’t a one-person job. It requires strong collaboration between Accounts Payable, Accounts Receivable, the IT team and other relevant departments.

She explains, “Thinking beyond your own department is crucial to ensure everyone is aligned and working towards the same goal.”

Compliance is not a choice – so stay ahead

Most importantly, Hajnalka reminds us that “compliance isn’t optional.”

Many organisations approach new technology cautiously, testing the waters to see if it’s worth the investment or if they have the budget for it.

But with new invoicing regulations, Hajnalka clarifies, “Compliance isn’t a choice - it’s the law. Non-compliance comes with serious consequences, and it’s essential to stay ahead of these changes.”

A big thank you Hajnalka for offering a new perspective on mandated e-invoicing. Her next challenge? To educate AP and P2P teams about this new wave of financial transformation. You can find her newsletter here.

If you’d like to feature alongside some of the industry’s finest at The AP Arms, please get in touch – we’d love to share a tipple with you down the pub!

Stay up to date with The AP Arms

Catch more of our The AP Arms episodes